PIX Payment Guide: Complete Tutorial for Brazil’s Instant Transfer System

This comprehensive PIX payment guide will teach you everything about Brazil’s revolutionary instant transfer system. Learn how to use PIX safely, understand limits, and fund your accounts with step-by-step instructions.

What is PIX Brazil’s Payment System?

PIX is Brazil’s instant payment system launched by the Central Bank of Brazil in 2020. Furthermore, it allows you to transfer money in real-time 24/7, including weekends and holidays. Learn more about PIX official regulations.

Preparing for Your PIX Payment

What You’ll Need:

- An active bank account in Brazil

- Your bank’s mobile app or internet banking access

- Recipient details: PIX key, CPF/CNPJ, phone number, or email

- The amount you want to transfer (limits are set by your bank)

Check Your Limits:

- Your bank sets daily PIX limits for your security. Additionally, they typically range from R$ 1,000 to R$ 20,000.

- Moreover, night transfers (8:00 PM – 6:00 AM) have reduced limits for your protection.

- Consequently, you can modify these limits in your banking app, but for security, changes usually take 24 hours to go into effect.

PIX Payment Guide: Step-by-Step Instructions

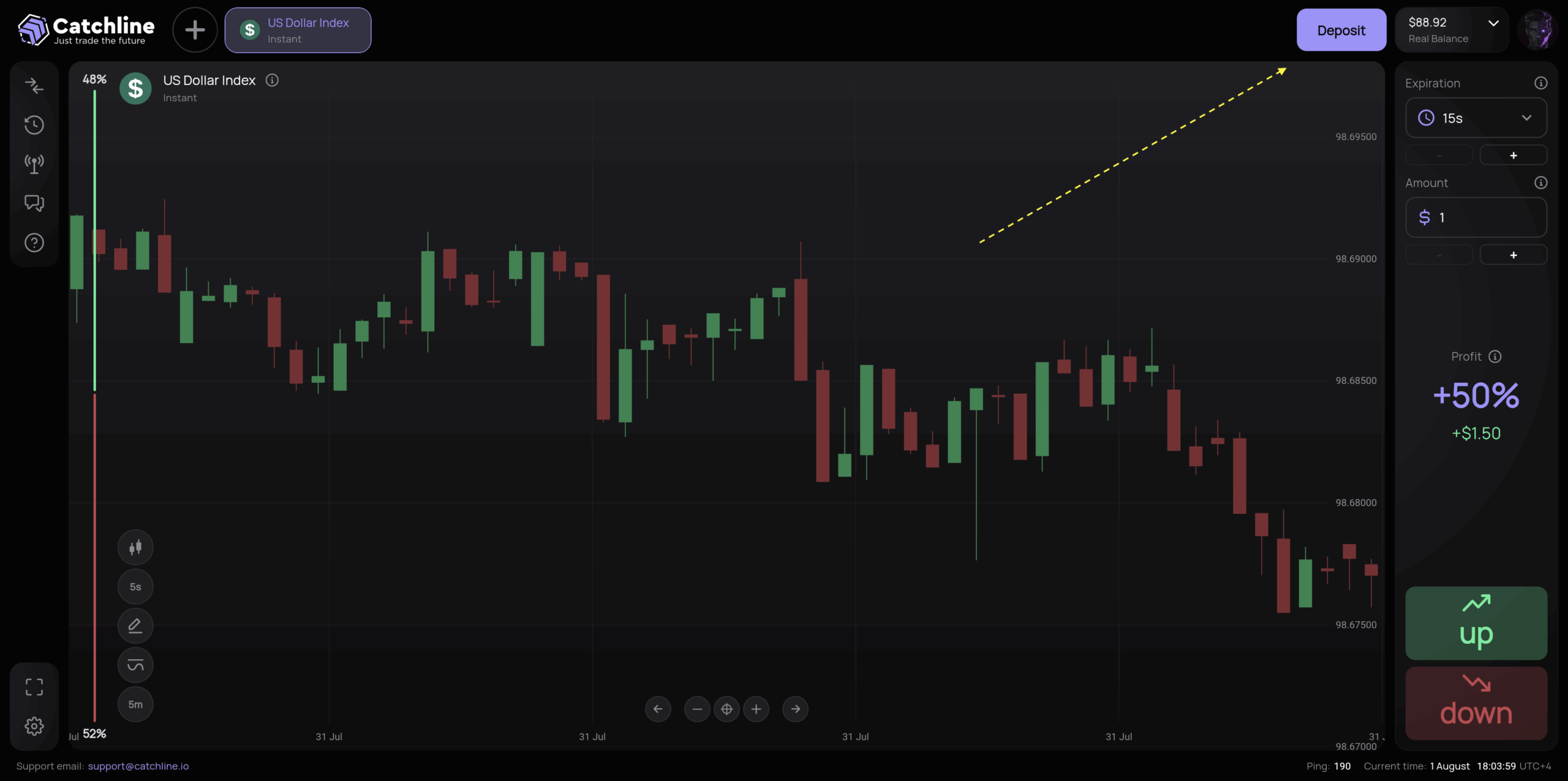

How to Fund Your Account via PIX on Catchline.io

Funding your account with PIX is simple, fast, and secure. Here’s our detailed step-by-step guide:

1. First, go to Catchline.io and log into your account.

Catchline.io login screen for Brazil instant transfer system setup” width=”2560″ height=”1275″ loading=”lazy” />

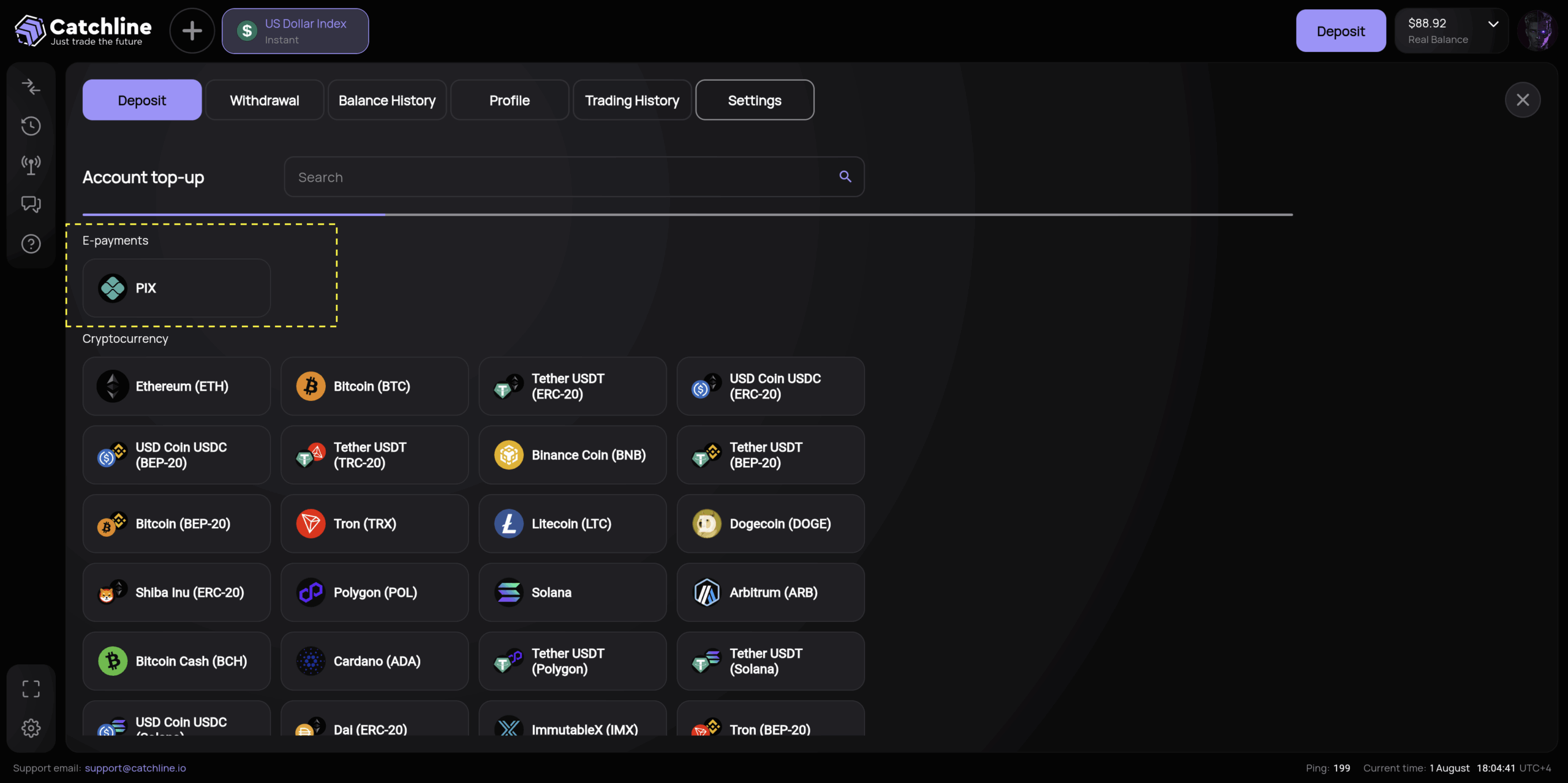

Catchline.io login screen for Brazil instant transfer system setup” width=”2560″ height=”1275″ loading=”lazy” />2. Next, navigate to the “Deposits” section in your personal dashboard.

3. Then, select PIX as your payment method.

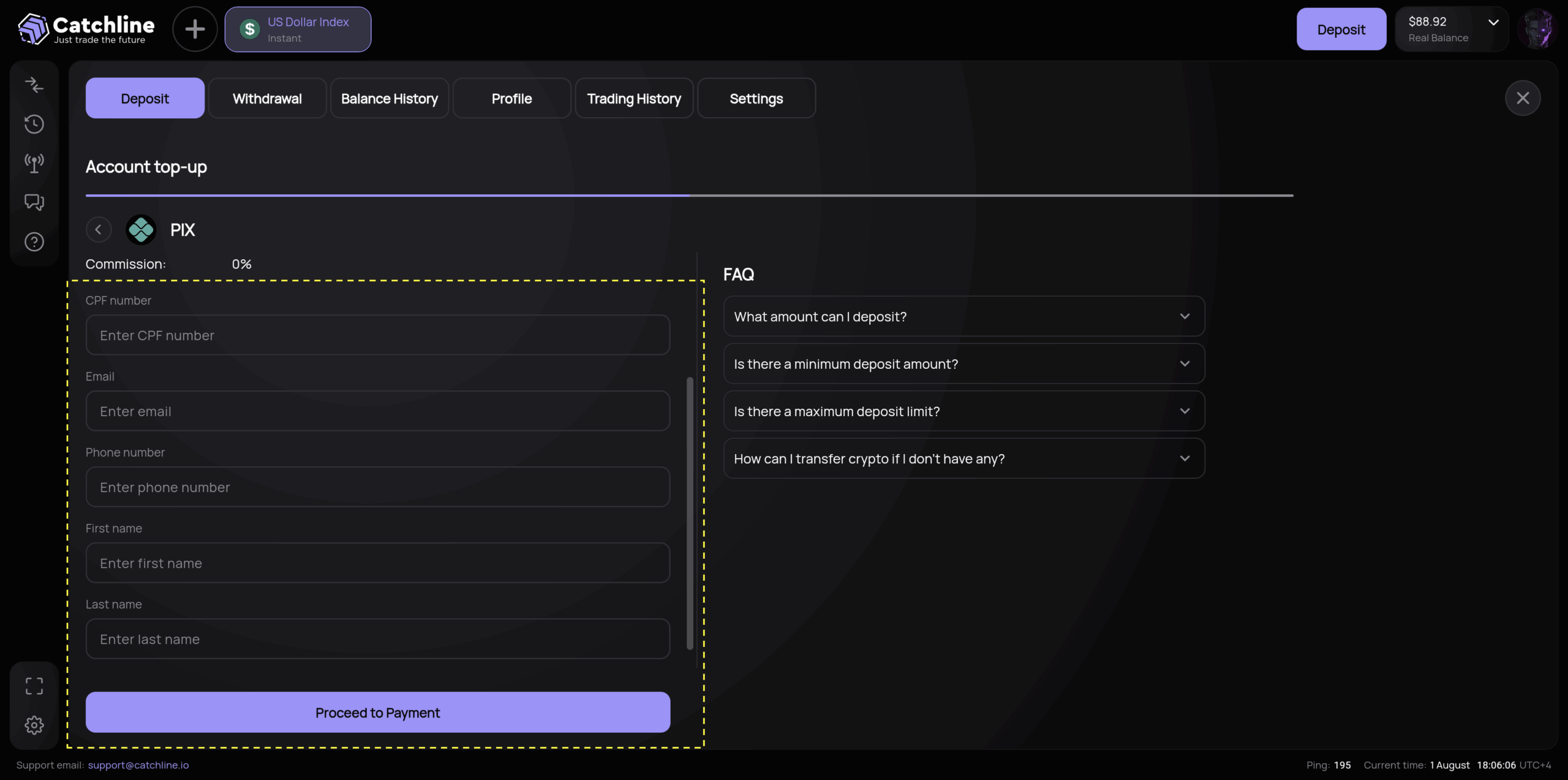

4. Subsequently, enter the amount you want to deposit and fill in the required information.

5. Afterward, click the “Proceed to Payment” button.

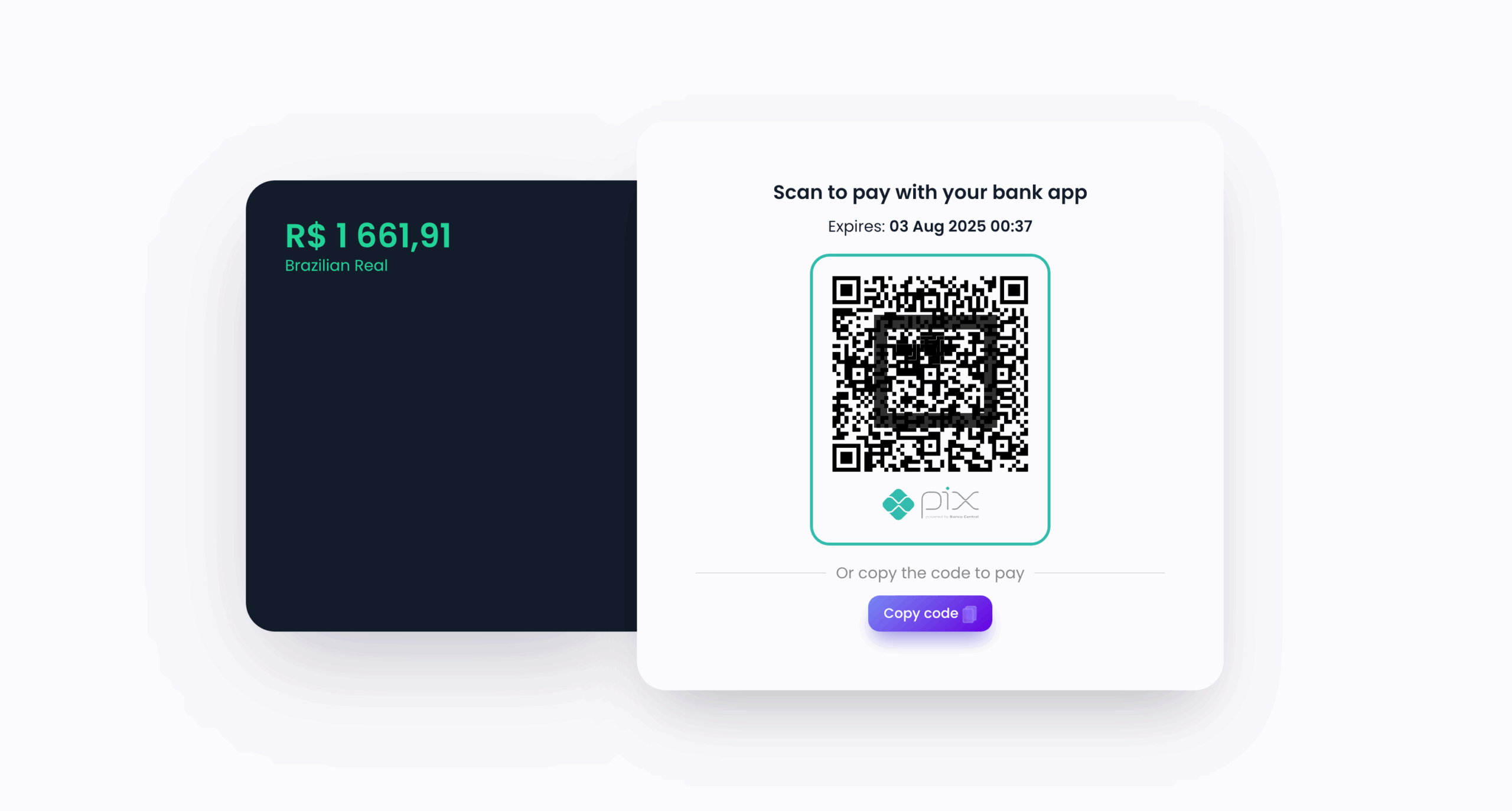

6. Then, the system will generate a QR code for payment.

7. Finally, open your banking app, select PIX payment, and scan the QR code or manually enter the generated key.

8. Ultimately, confirm the payment in your banking app — funds will be credited instantly.

Make sure you’re using a banking app that supports PIX. Transfers happen in real-time — no delays or fees.

Security When Using PIX Payments

Safety Measures:

- Always verify the recipient’s name before confirming

- Don’t share your PIX keys with strangers

- Check QR codes – only scan codes from trusted sources

- Save receipts of all transactions

- Set up notifications for incoming and outgoing transfers

Signs of Fraud:

- Requests to urgently send money to unknown people

- QR codes from suspicious sources

- Incorrect recipient names

- Pressure demanding immediate transfers

PIX Payment Limits and Restrictions

Daily Limits (6:00 AM – 8:00 PM):

- Usually R$ 1,000 – R$ 20,000 per day

- Depends on your bank and account type

- Can be changed in settings (with next-day confirmation)

Night Limits (8:00 PM – 6:00 AM):

- Usually R$ 1,000 per period

- Introduced for additional security

- Cannot be modified

Check current PIX limits and regulations from Brazil’s Central Bank.

Popular Brazilian Banks Supporting PIX

All major Brazilian banks support PIX payments:

- Banco do Brasil

- Bradesco

- Itaú

- Santander

- Caixa Econômica Federal

- Nubank

- Inter

- C6 Bank

Frequently Asked Questions About PIX

Q: Does PIX work on weekends?

A: Yes, PIX operates 24/7, including weekends and holidays.

Q: Are there fees for PIX payments?

A: PIX is usually free for individuals. However, some banks may charge fees if you exceed a certain number of monthly transactions.

Q: Can I cancel a PIX transfer?

A: No, PIX transfers are instant and irreversible. Returns are only possible with the recipient’s consent.

Q: Is PIX secure?

A: Yes, PIX uses high security standards and encryption, but it’s important to follow safety precautions.

Q: Can I use PIX for international transfers?

A: No, PIX only works within Brazil between Brazilian banks.

PIX Payment System: Final Thoughts

PIX is a convenient, fast, and usually free way to transfer money in Brazil. Key principles for successful use:

- Always verify recipient details

- Follow security measures

- Save transaction receipts

- Know your limits

- Contact your bank when in doubt

In conclusion, PIX has revolutionized financial transfers in Brazil, making them instant and available around the clock.

👉 Start now at Catchline.io