Brazil Trading Opportunities: Economic Signals Smart Traders Watch

Brazil trading opportunities have reached unprecedented levels in 2025, presenting unique market conditions for savvy traders. With central bank policies, US trade tensions, and currency volatility creating perfect Brazil trading opportunities, here’s how to capitalize on these profitable market developments.

Current Brazil Trading Opportunities Analysis

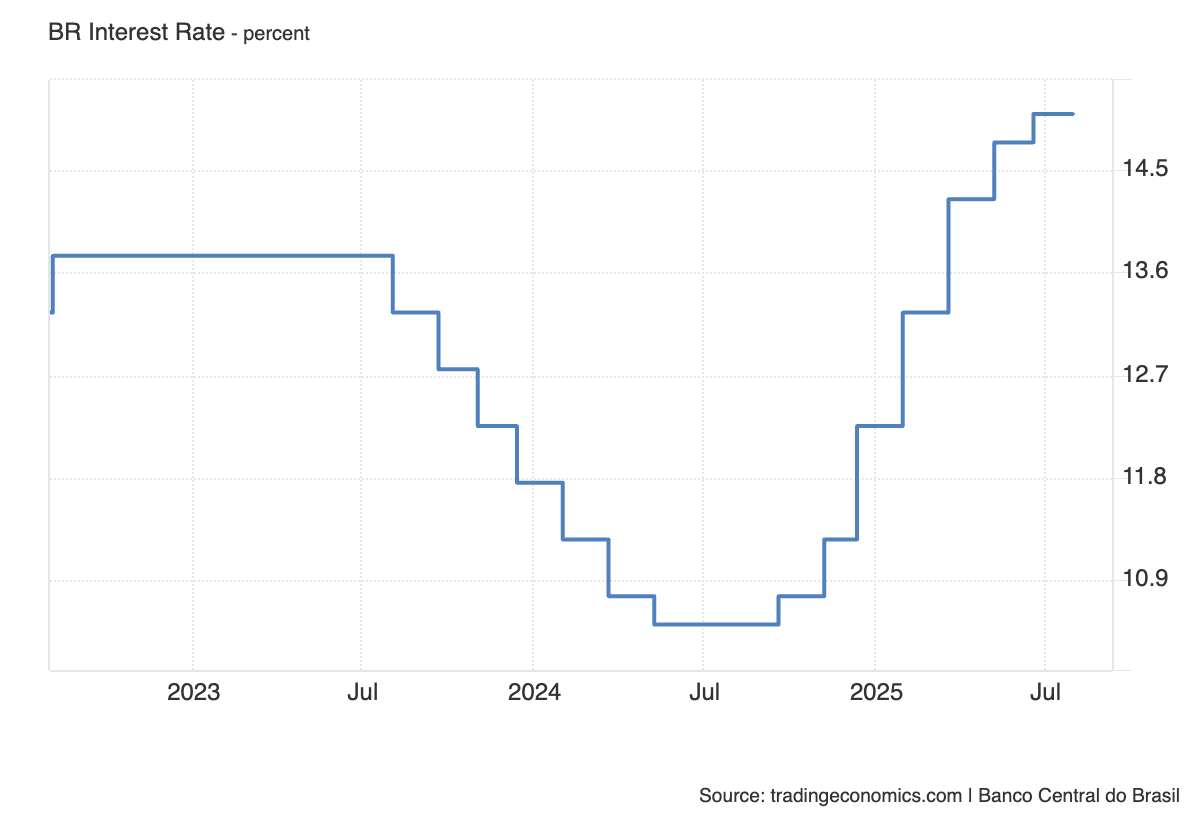

In July 2025, Brazil’s Central Bank (Copom) paused its monetary tightening cycle, keeping the benchmark Selic rate at 15% — the highest level since 2006. This creates significant market opportunities as traders assess the cumulative effects of prior policies.

Reuters — Brazil pauses rate hikes

US Tariffs Create New Brazil Trading Opportunities

Further tension came as the U.S. imposed 50% tariffs on a range of Brazilian exports, including metals, oil, and agricultural products. This decision creates immediate trading opportunities, pressuring the Brazilian real and increasing market volatility.

Reuters — US tariffs hit Brazil

Brazilian Market Response and Trading Potential

Despite Brazil offering one of the highest real interest rates globally, these conditions generate exceptional profit potential. The real began weakening following US tariffs, with inflation at 5.3%, and economists don’t expect rate cuts before January 2026.

Reuters — Currency & inflation

How to Maximize Brazil Trading Opportunities

Catchline is perfectly positioned to help you seize these market opportunities. Instead of buying assets, you predict whether prices will go up or down — getting results within minutes from Brazilian economic events.

Platform Features for Trading Success:

- Trade directly on economic and geopolitical news

- Low entry barrier — from just $1

- Profit on both upward and downward moves

- Seamless mobile experience for quick trades

Brazil Market Trading Strategies on Catchline

| Brazil Economic Event | Trading Strategy on Catchline |

|---|---|

| Selic rate remains at 15% | Predict BRL and Ibovespa movements based on market reactions |

| U.S. imposes 50% tariffs | Trade on BRL depreciation and increased volatility |

| Inflation stays above 5.3% | Capitalize on volatility and potential policy changes |

| Rate cuts delayed until 2026 | Predict sideways movements and risk-off market sentiment |

Expert Tips for Brazilian Trading Success

When pursuing profitable market opportunities, focus on:

- Central bank communications and policy signals

- US-Brazil trade relationship developments

- Brazilian real volatility patterns

- Commodity price impacts on Brazilian exports

Capitalize on Brazil Trading Opportunities Now

Brazil’s current situation represents a textbook case of high market reactivity, driven by central bank policy and global trade tensions. These aren’t threats — they’re strategic windows for informed traders.

Catchline provides the perfect tools to act on these events: fast, flexible, and straightforward. If you want to capitalize on real-world Brazilian market developments rather than wait years for long-term growth — start trading today.

Ready to Trade Brazilian Markets?

👉 Start now at Catchline.io